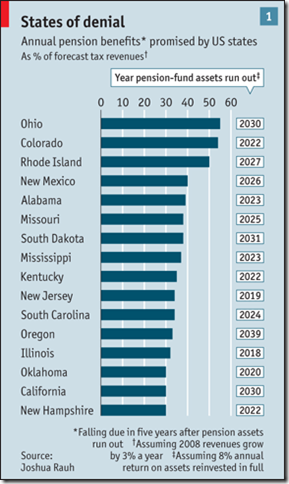

What is the structural weakness in the US economy? Some might point to the flight of manufacturing, some might point to duff mortgages, but I would point to the parlous finances of the various States Governments. A recent article in The Economist considers the impact of retiring Boomers (along with their sense of entitlement), State finances, and the lack of funding for State pension schemes. Apparently, 7 out of 50 States will have exhausted their pension assets by 2020, and half will have run out of money by 2027. The impact of this on the State tax revenues makes even more interesting reading. It would seem that current employees are working under an illusion that the promises made are affordable, whereas they quite possibly are not, as the following table suggests.

Of course, the bond markets will intervene well before this scenario occurs, but it does suggest that, towards the end of this decade, a crisis in State funding – along the lines of the crisis in the Eurozone – will befall the Dollar.

Ooops … it looks as if we can’t afford to retire!

© The European Futures Observatory 2010

No comments:

Post a Comment